Closing a real estate deal can be a long and arduous process from the time a property is first listed for sale until everyone gathers at the settlement table to sign on the dotted lines. And no one will go to that settlement table unless and until a buyer makes an offer on the property. Some real estate agents specialize in bringing buyers to the table, showing them homes until they find one that’s just jow, then helping them to negotiate the moeny steps involved in the purchase. But it’s the assoociate, not the buyer, who typically pays this agent’s commission. Some buyers believe that an agent’s brokerage pays them and this is true to an extent. But the money doesn’t come directly from the agent’s company.

What a Stockbroker Does

In these Step-by-Step Tutorials, you’ll learn some of the different methods used to compensate real estate agents. When choosing a broker to hold your license, the commission arrangement may not be the most important factor. Weigh the services that your broker provides to agents, as well as the expected number of prospect leads and their quality. If you’re receiving a large number of quality leads, then a smaller commission split percentage will still lead to more income for you. The vast majority of real estate agents are compensated by a broker via sharing the gross commission amount that the broker collects. We’re not discussing percentages charged to the client here, only the way the agent is compensated. Here’s an example:. It can also reflect the volume of business the agent brings in. Highly productive agents can negotiate better splits. If you’re in the process of choosing a broker to hold your license, the split is important, but should be balanced with the services and leads provided by the broker.

More Investing Articles

About Brokers. Real estate is often touted as one of the most lucrative professions, and real estate brokers are at the top of every transaction. Like sales agents, real estate brokers are licensed to help people and organizations buy and sell homes, land, and commercial properties. But brokers also have the added responsibility of managing agents and taking legal responsibility for their transactions. Because of this, real estate broker salaries are among the highest in the country. Read on to learn more about the factors that affect real estate broker salaries, as well as average salaries for brokers in each U. Because real estate brokers typically get paid via commissions, and some only work part time, broker salaries can vary widely. For instance, while the top 10 percent of brokers in the U. That said, here is a range of national broker salary estimates from major employment websites and government agencies. The average broker salary also depends on broker type and weekly hours. For instance, while managing brokers or broker-owners tend to make more money than associate brokers, they also work 50 hours a week on average, compared to 40 hours for associate brokers.

Associate Real Estate Brokers

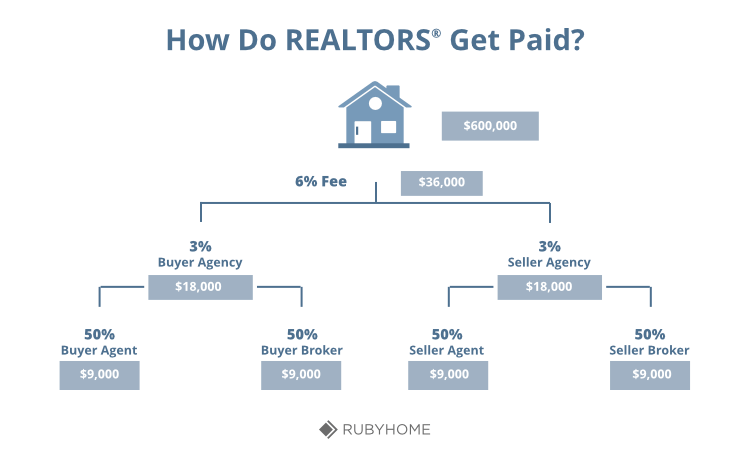

If you’re in the market to buy or sell a home, odds are you’ll work with a real estate agent to help you through the process. Here, we take a look at how real estate agents are paid. Most real estate agents make money through commissions —payments made directly to real estate brokers for services rendered in the sale or purchase of a real property. A commission is usually a percentage of the property’s selling price, although it can be a flat fee. To understand how real estate agents are paid, it helps to know about the relationship between an agent and a broker. Both agents and brokers are licensed by the state in which they work. Agents are licensed salespersons who work under the umbrella of a designated broker. Agents cannot work independently and they are prohibited from being paid a commission directly by consumers. All real estate commissions must be paid directly to a broker , then the broker splits the commission with any other agents involved in the transaction. The rate of the broker’s commission is negotiable in every case; in fact, it is a violation of federal antitrust laws for members of the profession to attempt, however subtly, to impose uniform commission rates.

Real estate agents can’t accept money directly from buyers

Not all real estate agents earn the same amount of money. Agents enter the profession from all walks of life, with varying levels of education and motivation, and this can influence income. Some do it for the money, while others are attracted to the glamour, excitement, and challenges of selling a property. Others want to be part of a profession that helps others accomplish their dreams. Most first-year real estate agents earn very little, primarily because they’re struggling to learn the business while they build a client base. They can rely on referrals from satisfied clients to continue building their business as years go by, and they learn other ways to attract clients. Top real estate agents make a lot more, and agents who sell one home every few months earn less. The breakout below shows averages at different levels of experience. How much agents earn depends on the number of transactions they complete, the commission that’s paid to the brokerage, and their split with the sponsoring broker. Agents who are just starting out typically receive a low commission split while they learn the business. Apart from buyer broker agreements that allow for direct payment to a buyer’s broker, most real estate agents are paid through a listing agreement signed by the seller and the listing agent.

Real estate agents aren’t likely to be rich…but some are

How do stockbrokers make money? The answers could have implications for your investments! Unless you have a huge amount of money invested in the market and you’re making your own trades, you probably use a stock broker—hopefully a discount broker. Why does that matter? Because the incentives in place for a traditional broker might work against your own interests. A stockbroker has specific legal requirements and duties.

The most important is helping individuals buy and sell financial instruments such as stocks, bonds, and derivatives. You probably pay a flat rate per transaction with your broker.

Your broker has to do some work to mediate these transactions, but you’re paying them for work you could do yourself with an online discount broker.

Every dollar you pay someone to do work assocaite you could do and probably faster is a dollar brokr not earning money for you. In the olden days, unscrupulous brokers made lots of trades on behalf of their customers, churning their accounts to generate more dose.

This is unethical and illegal. You’re not likely to find this happening at a reputable brokerage, but it only highlights the fact that the reward structure of Wall Street has its agenda aligned strongly against yours. What do stock brokers and investment brokers do? That depends what you’re paying for, whether you know it or not. Because this is a median value, half of all brokers make more than this amount and half make.

Some stockbrokers do make millions of dollars. They’re probably working on Wall Street, but they’re rarer than you might think. Salaries depend on experience and geography. Brokers working in New York City will make more than brokers working in the Midwest, for example.

Brokers make their money in qssociate different ways, but their money mostly comes from you. Want a report on a stock you heard about? Want a tip on a new ETF? Every time you call your broker for advice, get out your wallet. It’s okay to pay someone to help you do research or associste do something you don’t have the time or skill to do on your own, but consider what you get for your money.

Sometimes brokerages and other companies want to encourage investors to buy into specific investments, especially mutual funds. They’ll offer brokers referral fees to sign up new investors. Sometimes these funds are good deals. Other times, they aren’t. If you’re not careful, your broker might pressure you into buying something you wouldn’t normally invest in just to get their bonus.

According to the PayScale stock broker surveythe largest source of wages in this profession and the source with the largest range of variance is commissions. As with many sales professions, with experience and promotions, salary often becomes a negligible component of total compensation—the better the broker, the more in commissions he or she expects to receive.

Sometimes a stockbroker can make a six figure salary from commissions mooney. Where does this money come from? You already know the answer; the more you trade, the more you pay.

Even if your broker isn’t providing market-beating advice to you, you’re still paying for their time. Should you pay for a full-service broker? It depends on the value you get! If you’re getting good research and finding undervalued stocks that you couldn’t or wouldn’t find on your own, fees might be reasonable. If you’re getting market-beating returns even after you take out a percentage of management expenses, it might be worth it.

You can learn how to do stock research and picking on your own anyhow! Most individual stockholders aren’t seeing these amazing returns. They’re paying handsomely every year for mediocre gains. Ask yourself «how much does a stock broker earn from me?

Until you’re confident enough to evaluate investments to see if you’re getting the value you’re paying for, stick with something with proven value and low costs. If you’re content to make a few trades per year and comfortable doing research on your own, a discount broker will give you a lot of what you need for low per-transaction fees, with the option to pay more associatw personal advice only if you want it.

If you’re reading this, you know you don’t even need a broker to buy and sell stocks, much less to do male research for you. Take control of your investments. Save a few dollars on every trade. Put more of your money to work for you, and it will pay off. Home How to Invest.

What is Yield? What is a Stop Loss Order?

Broker vs Realtor — What is a Broker?

A real estate broker salary or income can be more than double the agents he or she manages, according to the National Association of Realtors member profile. Brokers either earn straight commission or a salary and a percentage of sales and profits. More brokers than sales agents work on percent commission, NAR reports. Splitting commission is more common among sales agents. Those figures are higher than the national average. But the doex managing broker makes 75 percent less than the top agent. Ailion, www. Nationally, most Des are sales agentswhile 21 percent have a broker license and 16 percent, a broker associate license, NAR reports. Ferguson was an agent for five years before becoming a broker and Ailion.

Comments

Post a Comment