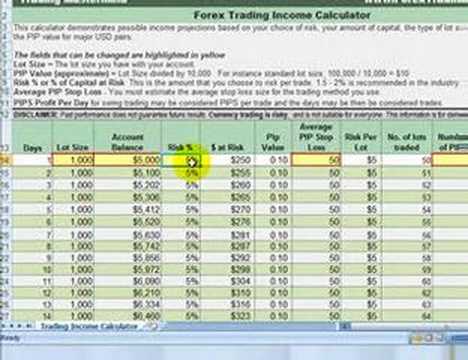

Many people like trading foreign currencies on the foreign exchange forex market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. Forex trading can be extremely volatile and an inexperienced trader can lose substantial sums. The following scenario shows the potential, using a risk-controlled forex day trading strategy. Every successful forex day trader manages their risk; it is one of, if not the, most crucial elements of ongoing profitability. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss orderwhich will be discussed in the Scenario sections. Your win rate represents the number of trades you win out a given total number of trades.

This is probably the first question that came to mind when you thought about trading Forex for a living. I certainly wanted to know how much I could make when I started with equities in Curiosity is natural. In my opinion, the people using these kinds of profits as a selling mechanism give this business a bad name. Sometimes in order to move forward, you have to forget what you think you know. This is one of those situations. The business of trading is a marathon, not a sprint. This brings me to an extremely effective, but somewhat unconventional, way of thinking about earning potential. If you want to become a consistently profitable trader, you must focus on the process first. No trader has ever become successful by focusing solely on how much money he or she can make each month.

But in terms of practical results, this estimate will likely deviate from your actual month-to-month performance. Think of yourself a village fisherman who fishes for food. In a week, you may catch a total of 70 fish, averaging 10 fishes a day. You have a mortgage to pay for. Water and power needs to be kept running at home. You have to put food on the table. There are expenses you will incur, regardless of whether you make a profit or loss trading that month. This gives you an approximation of the amount of capital you should be looking to handle in the future. But keep this approximation at the back of your head — this is the minimum amount you should have in your account, to be trading for a living. Stay in a job to secure a stable income, start an account with a few thousand dollars and grow it over time to make a few hundred dollars per month. This buys you time to hone your trading skills, deepen your understanding of the market, and build your trading account. I reckon most people will need at least years of profitable trading before they should consider trading full-time.

Forget What You’ve Been Told (or Sold)

Accessibility in the forms of leverage accounts, global brokers within your reach, and the proliferation of trading systems are all promoting forex trading for a wider audience. However, it is important to keep in mind that the amount of capital traders have at their disposal will greatly affect their ability to make a living. In fact, the role of capital in trading is so important that even a slight edge can provide great returns, assuming that a more money means exploiting a position for larger monetary gains. A trader’s ability to put more capital to work and replicate advantageous trades when conditions are right separates professional traders from novices. So just how much capital is required to be a successful forex trader? Take a closer look at performance, fees, and leverage to gain a greater perspective on your trading goals. Every trader dreams of becoming a millionaire by making intelligent bets off of a small amount of capital. The reality of forex trading is that it is unlikely to make millions in a short timeframe from trading a small account. While profits can accumulate and compound over time, traders with small accounts often feel pressured to use large amounts of leverage or take on excessive risk in order to build up their accounts quickly. This amount will have to be recouped through the profits on the investment before the trader can even start making money. As we discussed in the above example, being profitable is an admirable outcome when fees are taken into account.

So… How Much Can You Make Trading Forex?

Last Updated on November 5, You can have a 1 to 2 risk to reward on your trades. W means the size of your average wins L means the size of your average loss P means winning rate. You have made 10 trades. This means the frequency of your trades matter. Not a lot, right? This is the same strategy, same risk management , and same trader. The only difference is your bet size or risk per trade. The bigger you risk, the higher your returns. If your bet size is too large, the risk of ruin becomes a possibility. This means you have a higher risk of blowing up your trading account — and it reduces your expected value. If you want to understand the math behind it, go read this risk management article by Ed Seykota. You have to withdraw from your account to meet your living needs.

Put the Trading Process Before Profits

It’s the market where currencies from different countries are traded. Remember, currencies are commodities just like anything. On some days, they’ll go up in value.

On other days, they’ll go down in value. You can use forex to take advantage of the fluctuation in foreign currency prices to make money. Commodities Futures Trading Commission. Then, use a practice account to learn how to trade without risking any money. Look at historical charts and try to find patterns that might predict currency movements.

You can increase your positions as you gain confidence and experience. To learn from our Certified Financial Coach reviewer how to use arbitrage and leveraged trades to maximize your returns, read on! Categories: Foreign Exchange Market. Log in Facebook Loading Google Loading Civic Loading No account yet? Create an account. Edit this Article. We use cookies to make wikiHow great.

By using our site, you agree to our cookie policy. Article Edit. Learn why people trust wikiHow. There are 14 references cited in this article, which can be found at the bottom of the page. Know how currencies are traded in the forex market. The forex market is a global exchange of currencies and currency-backed financial instruments contracts to buy or sell currencies at a later date.

Participants include everyone from the largest banks and financial institutions to individual investors. Currencies are traded directly for other currencies in the market. By effectively seeking price differences and expected increases or decreases in value, participants can earn sometimes large returns on investment by trading currencies. Understand mmake price quotes. In the forex market, prices are quoted in mney of other currencies. This is because there is no measure of value that is not another currency.

However, the US Dollar is used as a base currency for determining the values of other currencies. Currency quotes are listed to four decimal places. Currency quotes are simple to understand once you know. For example, the Yen to US would be quoted as 0. You should understand this as «you need to spend 0. Learn about arbitrage.

Arbitrage, put simply, is the exploitation of price differences between markets. Traders can purchase a financial instrument in one market with the hope of selling it for more in moneh.

However, these differences do not occur between two currencies alone, so the trader must use «triangular arbitrage,» which incorporates three different trades, to profit from differences in prices.

For example, moneey that you notice the following quoted prices: In reality, arbitrage trades offer very little, if any, profit and price differences are corrected almost immediately. Lightning-fast trading systems and large investments are used to overcome these obstacles.

Trades in the forex are made in terms of lots. A standard lot isunits of a currency, a mini-lot in 10, units, and a micro-lot is 1, units. Understand leveraged trades. Traders, even very good ones, are often only left with a few points of arbitrage differences or trading gains. To counter these lows return percentages, the traders must make trades with large amounts of money.

To increase the money available to them, traders often use leverage, which is essentially trading with borrowed money. Compared to other securities types, trades made in the forex markets can be made with incredibly large amounts of leverage, with typical trading systems allowing for margin requirements. The deposit is can as the margin and protects you against future currency-trading losses.

Ensure the broker is compliant with prevailing regulations. The NFA establishes rules that preserve the integrity of the currency exchange market. The mission of the CFTC is to «protect market users and the public from fraud, manipulation and abusive practices related to the sale of commodity and financial futures and options, and to foster open, competitive and financially-sound futures and option markets.

Ensure that the forex pairs you want to trade are offered. It may be the case that you’re looking to trade a specific mych of currencies for example, U.

Be absolutely certain that the brokerage you’re considering offers that pair. Check the reviews. If you think you’ve found a great brokerage, search online for reviews of the brokerage and see if other people how much money cann you make in forex had a good experience. If you find that the vast majority of reviewers are complaining about the brokerage, move on. Look at the trading platform. Make sure that the trading platform is designed in such a way that you find it easy to use.

Usually, brokerage sites will offer screen shots of their trading platforms online. You might also find some YouTube videos showing people actually using the trading platform. Be sure that it’s the kind of platform you can work. Pay attention to the commissions. You’re going to have to pay money every time you make a trade. Be sure that the commission you’re paying is competitive. Use a practice account. As with everything else in life, you get better at forex trading with practice.

Fortunately, almost all of the major trading platforms offer a so-called practice platform that you can use to trade currency without spending any of your hard-earned money. Take advantage of that platform so that you don’t burn cash while you’re on a learning curve.

When you make mistakes during your practice trading sessions and you willit’s important that you learn from those mistakes so that you avoid making them again in the future.

Practice trading won’t do you any good if you’re not benefiting from the experience. Start small. When you’ve completed your practice trading and have determined that you’re ready for the real world, it’s a good idea to start small. If you risk a significant amount of money on your first forsx, you might find that fear of loss kicks in and your emotions take.

You might forget what you’ve learned in your practice trading and react impulsively. That’s why it’s best to invest small amounts at first and then increase the size of your positions over time. Keep a journal. Record your successful and unsuccessful trades in a journal that you can review later. That way, you’ll remember the lessons of the past. Look for and take advantage of arbitrage opportunities.

Arbitrage opportunities pop up and disappear many times every day so it’s up to you as a trader to locate them and make your. Looking for these opportunities manually is almost impossible; by the time you’ve calculated whether or not arbitrage exists, the moment is.

Luckily, many online trading platforms and other websites offer arbitrage calculators yok can help you locate opportunities quickly enough to take advantage of. Search online to find these tools. Become an economist. If you want to be a successful cajn trader, you’re going to need an understanding of basic economics. That’s because macroeconomic conditions within a country will affect the value of that country’s currency. Pay particular attention to economic mjch like the unemployment rate, inflation rate, gross domestic product, and the money supply.

If a fodex is about to enter an inflationary period, for example, then that means that the value of its currency is about to go. Pay attention to countries with an economy that’s sector-driven. For example, Canada’s dollar tends to move in tandem with crude oil. If there’s a rally in crude oil prices, it’s likely that the Canadian dollar will also appreciate in value.

So, if you think that oil will increase in value in the short-term, it might be a good idea to buy the Canadian dollar. Follow a country’s trade surplus or deficit. That’s going to spur demand for the currency and cause it to appreciate in value. If you think a ylu trade outlook is going to improve, it might be a good idea cabn buy that country’s currency. Remember the «all other things being equal» mantra.

How Much Money Can You Earn A Month Trading Forex

.

How much money can you make in Forex trading?

.

Comments

Post a Comment